Social media platforms have transformed from simple networking sites into bustling marketplaces. People now buy products, send money to friends, and pay for services without leaving their favorite apps. Payment processing innovations from various sectors have shaped these systems, and technologies refined across industries, from American Express casino platforms to retail, demonstrate how secure, instant transactions can work at scale. Social media companies now apply these same principles to billions of daily purchases.

This shift has changed how millions handle their daily transactions. The convenience factor drives this trend. Users appreciate the ability to complete purchases while scrolling through their feeds. No need to switch between multiple apps or remember various login credentials.

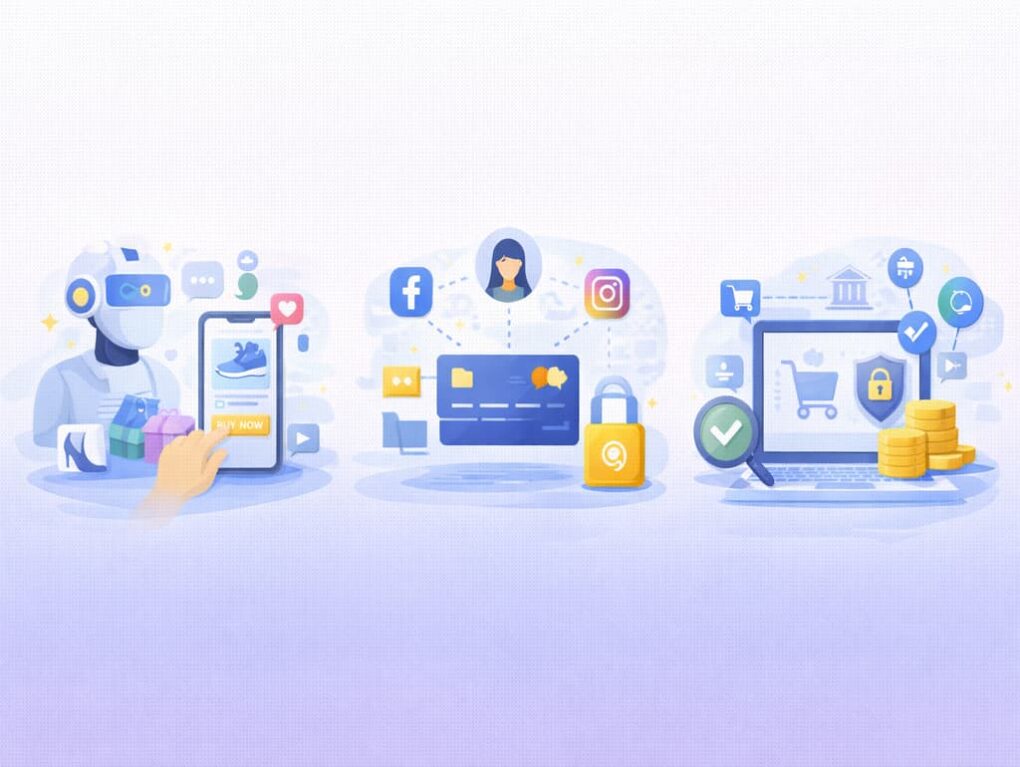

But how secure are these transactions? What payment methods work best? These questions matter as more people trust social platforms with their financial information.

How Social Media Payment Systems Work

Most platforms integrate payment processing directly into their interface. When someone clicks a buy button, the system securely processes their payment information. The transaction happens within seconds.

Behind the scenes, these platforms partner with established payment processors. These partnerships ensure transactions meet banking standards and fraud protection requirements. The user experience stays smooth while security remains tight.

Many platforms store payment information for future purchases. This feature speeds up checkout but raises privacy concerns for some users. Understanding how data gets stored helps people make informed choices.

Popular payment methods on social platforms:

- Credit and debit cards remain the most common payment option. Users simply enter their card details once and complete purchases with a single tap. Major card networks process these transactions reliably.

- Digital wallets have gained significant traction recently. Services like PayPal, Apple Pay, and Google Pay offer an extra security layer. They keep actual card numbers hidden from merchants.

- Platform-specific payment systems are emerging, too. Some social networks created their own digital currencies or payment ecosystems.

- Direct bank transfers work on certain platforms. This method suits larger transactions where users prefer avoiding credit card fees. Processing times vary depending on the banking system.

Payment Flexibility Across Platforms

Different platforms support different payment methods. Instagram focuses heavily on mobile wallet integration. Facebook Marketplace offers more traditional options.

Some platforms limit payment methods based on user location. Regional banking regulations influence these restrictions. Checking available options before shopping saves frustration.

Security Features Users Should Know

Encryption protects payment data during transmission. This technology scrambles information so hackers cannot read it. All reputable platforms use bank-level encryption standards. Modern encryption methods update regularly to stay ahead of emerging threats.

Two-factor authentication adds another security layer. Users verify their identity through a second device or method. This feature significantly reduces unauthorized access. Setting up this protection takes only minutes but provides lasting security benefits.

Purchase protection policies vary by platform. Some offer buyer guarantees similar to credit card protections. Others provide limited coverage. Reading the terms helps users understand their rights. Many platforms also offer dispute resolution services when transactions go wrong, helping buyers recover funds from fraudulent sellers or undelivered products.

Recognizing Secure Transactions

Look for security indicators before entering payment information. Locked padlock icons and “https” in URLs signal encrypted connections. These small details matter.

Monitor account activity regularly. Quick detection of suspicious charges prevents bigger problems. Most platforms send transaction notifications immediately.

The Future of Social Commerce

Augmented reality shopping features are being tested. Users might soon try products virtually before purchasing. Payment integration will happen seamlessly within these experiences.

Cryptocurrency payments may become more common. Some platforms already experiment with digital currency options. Mainstream adoption depends on regulatory clarity and user comfort levels.

Voice-activated purchases could streamline transactions further. Smart speakers already handle some shopping tasks. Social platforms might integrate similar capabilities.

What Changes Are Coming

Artificial intelligence will personalize shopping experiences. Systems will learn preferences and suggest relevant products. Payment processes will become even more frictionless.

Cross-platform payment systems might emerge. Users could maintain one payment profile across multiple social networks. This development would significantly simplify online shopping.

Social media companies continue investing in payment infrastructure. They recognize commerce as a major revenue stream. Users can expect more features and better security measures.

The landscape keeps evolving rapidly. Staying informed about new features helps users make smart choices. Digital payments in social media are here to stay.